Break the Bank

Alves Reis and the Portuguese currency crisis

Sam Burton

As long as reputable sovereign and financial entities have issued value-bearing notes, disreputable personages have attempted to imitate them for nefarious purposes. At times the counterfeiters have been nearly as productive as the legitimate mints. In the mid-nineteenth century, some 40 percent of all American currency was fake. But “fake” here is a relative term. With literally thousands of currencies circulating at the time, legal tender in Cincinnati might be little more than tinderbox fodder in Columbus. National currencies, too, often ended up stoking the auto-da-fé; those of the French Bank Royale, the Continental Congress, and the Confederate States are only the most notorious examples. Under such turbulent circumstances, the difference between value and valuelessness, between “real money” and ornate scrap paper, does not admit of definite boundaries.

Perhaps no one has challenged this distinction more effectively than the forgotten Portuguese entrepreneur and swindler Arturo Alves Reis. The latter epithet, though certainly apt, fails to capture the true essence of his crimes, which were both outlandishly reckless and touchingly devoid of malice. Producing wealth ex nihilo, Alves Reis was as much alchemist as con man. His specialty was spinning fictions that opened out onto the real, then closed behind him once he passed through. His career began early. Just after his twentieth birthday, in 1916, Alves Reis lit out for the Portuguese colony of Angola to make his fortune. In addition to a plump new bride, he brought with him a homemade diploma from the nonexistent Polytechnic School of Engineering of Oxford University. This diploma certified his mastery of the subjects of geology, geometry, theoretical and applied physics, metallurgy, paleography, and mathematics, as well as civil, mechanical, and electrical engineering. The sole genuine mark on the document was a notary seal. As the only Oxford graduate in Angola, Alves Reis soon found himself running the country’s rail system, an occupation he discharged with considerable alacrity, diagnosing mechanical failures in engines he had never seen before. Such success must have encouraged him: told by real engineers that some new equipment was too heavy for the trestles, he tested it himself, bringing his infant son along in flamboyant demonstration of his self-confidence. In short, Alves Reis did his invented alma mater proud.

Nest egg in pocket, Alves Reis returned to Lisbon in 1923 and went into business in a curiously non-specific way, buying and selling, exporting and importing whatever came his way. He soon met with his second opportunity to use fiction in pursuit of the real. Learning that a controlling interest in the Royal Trans-African Railway Company of Angola could be had for a mere forty-thousand dollars (which represented only a fraction of its cash reserves), Alves Reis engineered a “leveraged buy-out” avant la lettre: He kited a US check to buy the company, raided their coffers, and wired forty-thousand dollars of their own money to New York before the boat bearing his check could arrive at dock. An efficient scheme indeed, but when some influential members of the railway’s board ratted him out, he was tossed into an Oporto jail. A gross error on the part of the Portuguese authorities: they gave Alves Reis time to think. And what he thought about was the Bank of Portugal.

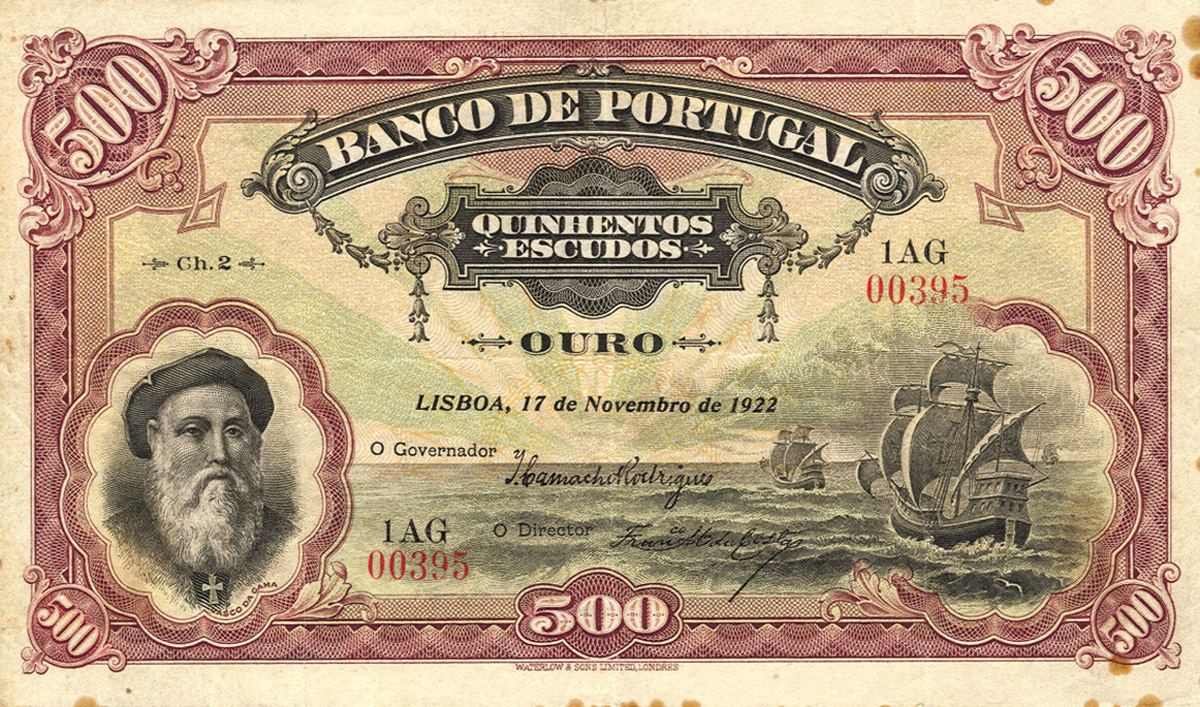

Reading through the bank’s bylaws, Alves Reis made some interesting discoveries. First, it was semi-private; the government held only a minority stake in the operation. Second, it had the exclusive right to issue Portuguese bank notes. Last but not least, no one was in charge of monitoring duplicate serial numbers. After fifty-four days of confinement, he emerged from jail with an utterly ludicrous plan the likes of which no self-respecting criminal could ever have conceived. It was not so much half-baked as inherently inedible. Alves Reis cobbled together a contract that specified that he, as a supposed agent of the Bank of Portugal, was authorized to request the printing of five million dollars in Angolan currency to be paid to an “international group of investors” in exchange for a loan to the Angolan government for the same amount in British sterling. After a night of cutting and pasting, Alves Reis took his contract over to a notary, whose assistant stamped his signature without a second glance. He then obtained the seals of the French, German, and English consulates, each attesting to the authenticity of the notary’s signature. The bureaucrats’ complicity seems to have had no more ulterior a motive than that they enjoyed stamping things.

With contract in hand, Alves Reis now rounded up his consortium of “international investors.” He basically chose the only foreigners he knew, but he could not have done better had he gone straight to central casting at Warner Brothers (indeed, the entire secondary cast of Casablanca could have found roles in a film version of this scheme). His co-conspirators were: Antonio Bandeira, a Portuguese diplomat posted in Holland, with the obligatory pile of gambling debts; his corrupt, skirt-chasing younger brother José, who had done time for grand larceny; a social-climbing Dutch importer named Karl Marang; and Adolf Hennies, an ostensibly respectable German financier with a shady background in war profiteering. Believing Alves Reis to be the front man for a cabal of corrupt officials out to shore up both their own and Angola’s finances, the group vowed complete secrecy as a requisite to participation in the scheme.

Next, the investors approached Waterlow & Sons, an English company that printed currency for the Bank of Portugal. Here we may pause to reflect on one of the central paradoxes of this story. After the Great War, Portugal, like many another small and/or impoverished nations, printed none of its own currency. All of the work was farmed out overseas, in part because they could not afford the requisite machinery. (One might imagine that where the printing of money is concerned, money would be no object. Alas, not so.) Intense competition for currency-making contracts among a handful of printers may explain why Sir William Waterlow, despite a lifetime in the trade, fell for Alves Reis’s story hook, line, and sinker.

Alves Reis’s scheme was extremely complicated. It depended on the fact that Angolan currency at the time was merely Portuguese currency that the Bank of Portugal would stamp with the word “Angola,” thus reducing its value by 90 percent. Angolan escudos were not convertible into any other currency, and as Sir William kindly pointed out, the amount of money that Reis’s investor group was receiving in exchange for the loan in sterling pounds in fact seemed unfairly low. Waterlow went so far as to counsel the group that they should be receiving a larger sum. What the printer did not know was that Alves Reis of course had no intention of devaluing his haul by placing the word “Angola” on the notes. For Alves Reis’s plan to succeed, however, he needed to provide Waterlow with a list of serial numbers for the bills they were about to print. Alves Reis knew that these numbers followed a strict set of parameters; for instance, that there were never two consecutive vowels in any given serial number, and so on. Having no access to the Bank of Portugal’s protocols, Alves Reis had to empirically deduce these rules by examining already circulating notes. What he lacked, however, was a master list of active serial numbers already printed by Waterlow on behalf of the Bank of Portugal. When providing the list of viable serial numbers to Waterlow, Alves Reis assured them that any serial numbers on this new list already printed in earlier batches would not conflict with currency already circulating in Portugal because the bills were destined exclusively for Angola. Since Alves Reis knew that there was no systematic supervision of duplicate numbers within the Portuguese banking system, he reasoned that any duplicates that he introduced into the Portuguese monetary system would never be detected.

After several breathless months, two of Alves Reis’s associates appeared at the Waterlow offices and were cheerfully handed several trunks full of freshly minted five-hundred-escudo notes. As the firm had worked from previously existing plates, the entire printing bill was less than two thousand pounds sterling. Back in Portugal, Alves Reis enlisted a crack squad of black-market currency traders to exchange as many Portuguese escudos as they could for British pounds and American dollars. Quite understandably, these men were suspicious of the notes; several checked samples with banks. Inevitably, as more of the five-hundred-escudo notes circulated, so too did rumors of counterfeiting. The situation became so critical that the Bank of Portugal itself was forced to intervene, issuing repeated assurances that no counterfeit bills had been detected. With the main victim of their crimes acting as press agent, the group felt emboldened. Mansions were constructed, fleets of automobiles purchased. Such was their prodigality that the moribund Portuguese economy began to show signs of life. Alves Reis’s notional fortune trickled down.

But as his partners were soon to learn at a meeting in Paris, the diminutive Portuguese schemer was just getting going. Topping his agenda was the placement of a reorder with Waterlow. (Ultimately, despite the limits of the original contract, they received the equivalent of around two billion dollars from the good offices of their British printer.) Secondly, Alves Reis told them, the cadre of money changers wasn’t cutting it anymore: They would have to charter their own bank. The Bank of Metropole and Angola, as they would name it, would carry them until they got to phase three: control of the Bank of Portugal itself. In his initial prison-time research, Alves Reis had discovered that the bank was the only agent of the government empowered to prosecute counterfeiters. He had thus plotted from the beginning to transfigure his imaginary millions into a real controlling interest of the country’s central bank, thereby keeping himself safe forever more from discovery and further incarceration. Just as he had surmounted the deception of his Oxford diploma by becoming a first-rate engineer and made good on the kited checks once they had gained him access to the coffers, he now aimed to attain a position from which he could retroactively negate his criminal act. Plus, he wanted to be a big shot.

He set one of his associates, José Bandeira, the task of acquiring shares in the central bank as discreetly as possible. This worked for a while, but as word of the transactions spread, the shares grew ever dearer and scarcer. Bandeira soon found himself at the foot of a very steep acquisition curve. What he and his fellow “international investors” made of their situation at this point is far from clear. Alves Reis had exacted an enormous cut off the top, which he claimed was owed to his patrons at the Bank of Portugal. His co-conspirators’ acquiescence to this demand would seem to indicate that they continued to cling to the notion that they were doing the bidding of legitimate, if corrupt, Portuguese officials. Ultimately, their failure to see through Alves Reis’s fictions, if failure it was, can be attributed only to a collective willful blindness to the obvious. No one, for instance, appears to have been much troubled by the fact that no loan to Angola was ever proposed. No one, that is, except Alves Reis himself, who seems to have had a genuine love of, and loyalty to, Portugal’s vast, dirt-poor, calamitously administered colony. As soon as his Bank of Angola and Metropole was chartered, he set out with his wife for a triumphal return visit. During this tour, he contrived a master plan for renewing Angola’s infrastructure with streets, harbors, and railroads. He gained control of something on the order of one million acres of land and was hailed in the local press as Angola’s Cecil Rhodes.

Unfortunately, none of it was to be. As Alves Reis’s return steamer approached Lisbon, friends boarded with the news that police were waiting at the dock to arrest him. Some weeks earlier, a teller in Oporto had phoned the central bank to report his conviction that the Bank of A&M was distributing counterfeit five-hundred-escudo bills. Eager for tangible proof of Reisian malfeasance, the authorities hurried forth to Oporto to inspect the notes in question. Again and again, their experts pronounced them authentic. They assuaged their disappointment by sifting through the holdings in the A&M vault. Here, finally, they uncovered duplicate serial numbers and issued an arrest warrant. The German financier Hennies, who had been traveling with Alves Reis, jumped ship, but Alves Reis himself met his dockside fate with dignity and the unfounded conviction that he could beat the rap. His final struggle to exonerate himself brought out his worst. From a well-appointed cell, he forged documents that incriminated innocent Bank of Portugal officials; many were disgraced. The economy resumed its downward spiral, and an economics professor named Antonio de Oliveira Salazar was eventually brought to power to restore political and fiscal order. He would remain the dictator of Portugal for thirty-six years. Alves Reis, it goes without saying, found religion in jail and died a self-righteous pauper.

During his years of incarceration, Alves Reis frequently asked himself why the notes Waterlow produced for him should be worth any less than the ones they printed for the Portuguese state, and this question remains valid from a theoretical, if not legal, standpoint. Through what act of transubstantiation did theirs become “real money”? Certainly not by virtue of some reserve of metal or foreign currency. Like virtually every other nation, Portugal produced many times more in notes than they had lying around in so-called tangible wealth. The “value” of money is ambiguous in a paper era. After all, civilization is more or less predicated upon a fetishization of gold, with its accompanying religious associations of the marriage of sun and earth. So strong is the tendency to identify value-as-such with this metal that it is only since the Depression that the Western world has formally severed the connection. Humankind seems sentimentally attached to the idea that in order to be of value, money must also have value. The trouble, of course, is that the two do not always run on parallel tracks. If, for example, massive amounts of gold are discovered in the Yukon, or you happen to stumble onto a New World choking on its silver, the value of those metals will decline far below the value they represent as money. Conversely, in the early 1960s, when silver was suddenly scarce, the value of the silver in a silver dollar jumped to $1.25, and that venerable metal had to be permanently expunged from the coin of our realm.

Thus the conversion to a paper economy represents the stripping away of the sentimental, irrational (and just plain heavy) material component of money, leaving the abstract, symbolic (and actual) aspect to circulate more freely. In Peircian terms, the iconic component of the monetary sign drops out. For the German philosopher/sociologist Georg Simmel, writing at the dawn of the twentieth century, this movement toward “pure” money represented a qualitative societal shift away from the qualitative. Money allows for the rationalization and depersonalization of exchange. With its advent, all things and all values can be compared. But this only imperfectly covers a deeper truth, as Simmel puts it: “The question as to what value really is, like the question as to what being is, is unanswerable.”

Where Simmel connects value to being, I see its analogue in language. Just as by some accounts language represents a kind of social taming of the “natural signs” (Augustine) or “affective categorizations” (Brunner et al.) spontaneously produced by the mind, so money can be seen as a codification of a swirling torrent of subjective valuations. In both cases, the patina of rationalization bestowed by the socializing process has engendered the hope of recovering logical foundations for the fields. In the case of language, it took the better part of the last century to establish that no such foundation was necessary (Wittgenstein) or possible (all of France). Instead, we make do with free-floating signifiers, trading off absences with one another in linguistic games deeply rooted in “forms of life.” Despite its analytical, mathematical aura, it may be that economics is in an analogously ungroundable position. Here, too, the meaning is in the use. Basic questions admit of contradictory answers. How much money is there in the world, for example? There are at least three ways to count, none satisfactory. Inflation is another minor scandal. If you ask how much a dollar in Alves Reis’s day is worth in ours, the answer ranges from $10.48 using the consumer price index to $48.26 using per capita GDP, all the way up to $121.03, based on something called “relative share of GDP.” (Calculating inflation involves obvious irrelevancies: No quantity of five-hundred-escudo notes in 1925 could buy you an iPod or a course of penicillin.)

Just as literary translations are merely an approximation of the original text, as readers of the Flemish version of this essay will agree, translating monetary sums across time and even across currencies is at best an imperfect practice. For this reason the ultra-rational Economist, only half in jest, annually gauges the value of currencies based on their power to purchase Big Macs. Monetary signifiers are at least as much a product of belief, trust, desire, and social practice as linguistic ones. Severed from a limiting referent such as gold or real estate, these signs traverse the globe at warp speed. Under these conditions, a nation cannot be too protective of its symbols, because it is difficult even to say what a “counterfeit symbol” might be. One could argue that Alves Reis was not so much a counterfeiter as a kind of monetary plagiarist.

Enthusiasts of avant-garde Portuguese literature, of which there must be dozens, will no doubt have noted to themselves that three years after Alves Reis lit out for Portugal, a certain Ricardo Reis, physician and lyric poet, set sail for Brazil. This latter Reis was one of the several fictive alter egos through whom Ferdinand Pessoa imported modernism into Portugal. It is possible that Alves Reis was one of Pessoa’s patrons. What could be more fitting than imaginary poets living off of imaginary money? And perhaps Alves Reis was inspired by Pessoa’s novella The Anarchist Banker, published in 1921. Alas, at present I am unable to discover any evidence of a relationship between the two. But with a little cutting and pasting, and the cooperation of a notary, I should have something ready by next Thursday.

Sam Burton lives in Northampton, Massachusetts.

Spotted an error? Email us at corrections at cabinetmagazine dot org.

If you’ve enjoyed the free articles that we offer on our site, please consider subscribing to our nonprofit magazine. You get twelve online issues and unlimited access to all our archives.