Artist Project / Meanwhile in Nigeria…

Mrs. Miriam Abacha has a problem

Julieta Aranda

The circulation of the counterfeit money can engender, even for a “little speculator,” the real interest of a true wealth. Counterfeit money can become true capital. Is not the truth of capital, then, inasmuch as it produces interest without labor, by working all by itself as we say, counterfeit money? Is there a real difference here between real and counterfeit money once there is capital? And credit? Everything depends on the act of faith and the credit we were talking about.

—Jacques Derrida, Given Time: I. Counterfeit Money

Credit in turn is the generation of a debt and the promise that said debt will be paid—the promise that there will be money. The deregulation of the banking system in the 1990s made it possible to trade on these promises of money as if they were money, and eventually they became money. This was essentially an act of trust between both parties in the transaction.

Some of the most enthusiastic recent debtors to join this cycle of promises were first-time home-owners —mostly low-income families and racial minorities trying to climb their way into the middle class by owning property. The exchange was one in which these first-time home-owners were “given” property after making an unrealistic promise of repayment, drafted in terms that included exponential interest rates hidden in the fine print.

Due to these fine-print issues, the aforementioned promises of payment routinely remained unfulfilled in recent years. Countless first-time home-owners defaulted on their mortgage payments, while their “IOUs,” which had been repackaged and traded as good honest money by financial institutions worldwide, ultimately generated gaping deficits of immaterial wealth spread evenly among the global economy.

And so it came to pass that the world’s financial system was brought to its knees by the unfulfilled promises of poor people, by money that never existed in the first place.

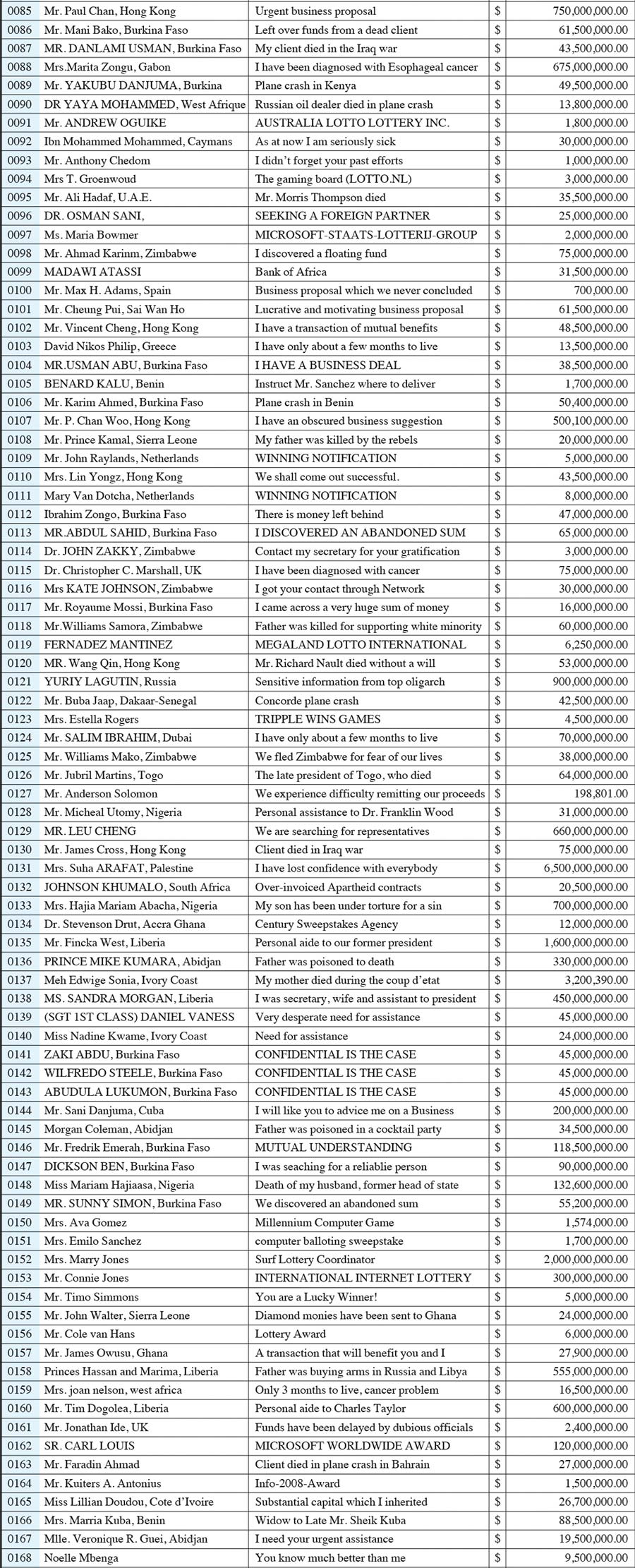

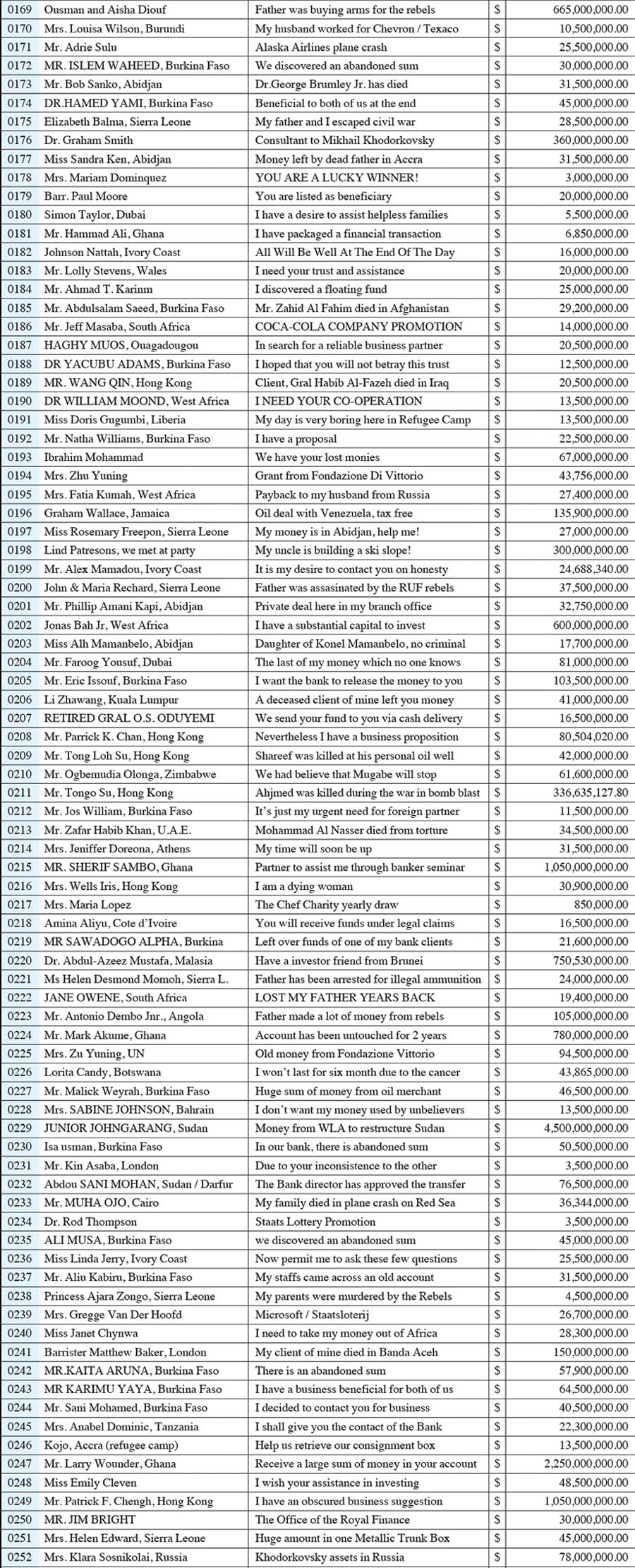

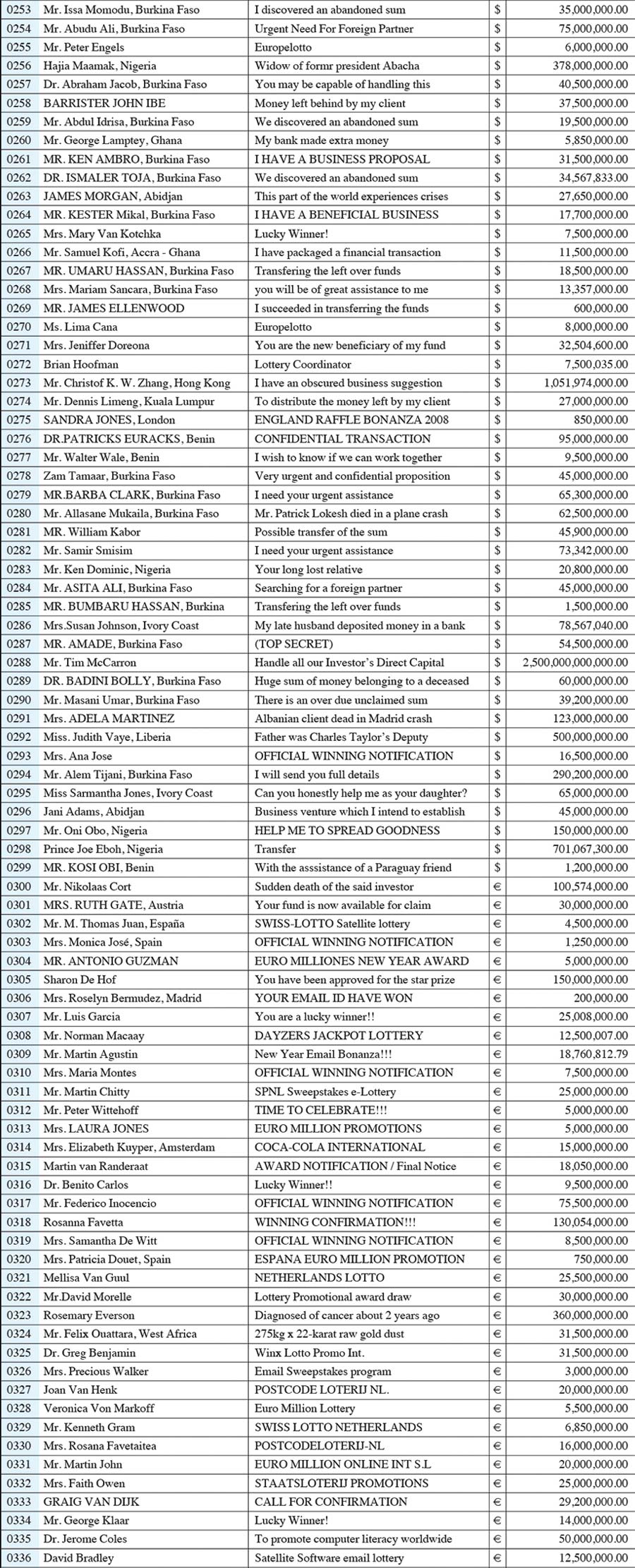

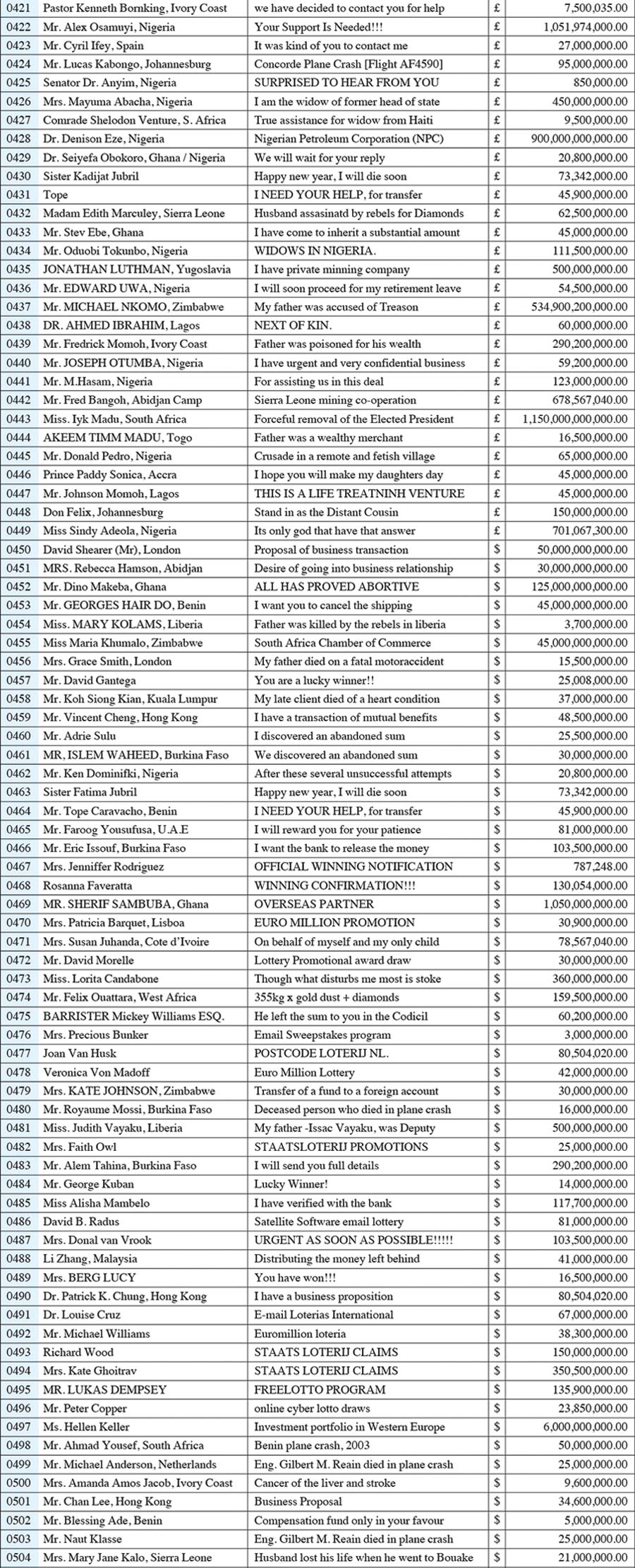

And she is hardly alone in her predicament. There is also Mrs. Margaret Muteta, who managed to escape Zimbabwe after a brutal assault on her family by the forces of president Mugabe. Her husband died, and several murder attempts were made on her life, but she was lucky enough to find her way out of Zimbabwe, with her children and with the large sum of cash monies that he inherited her.

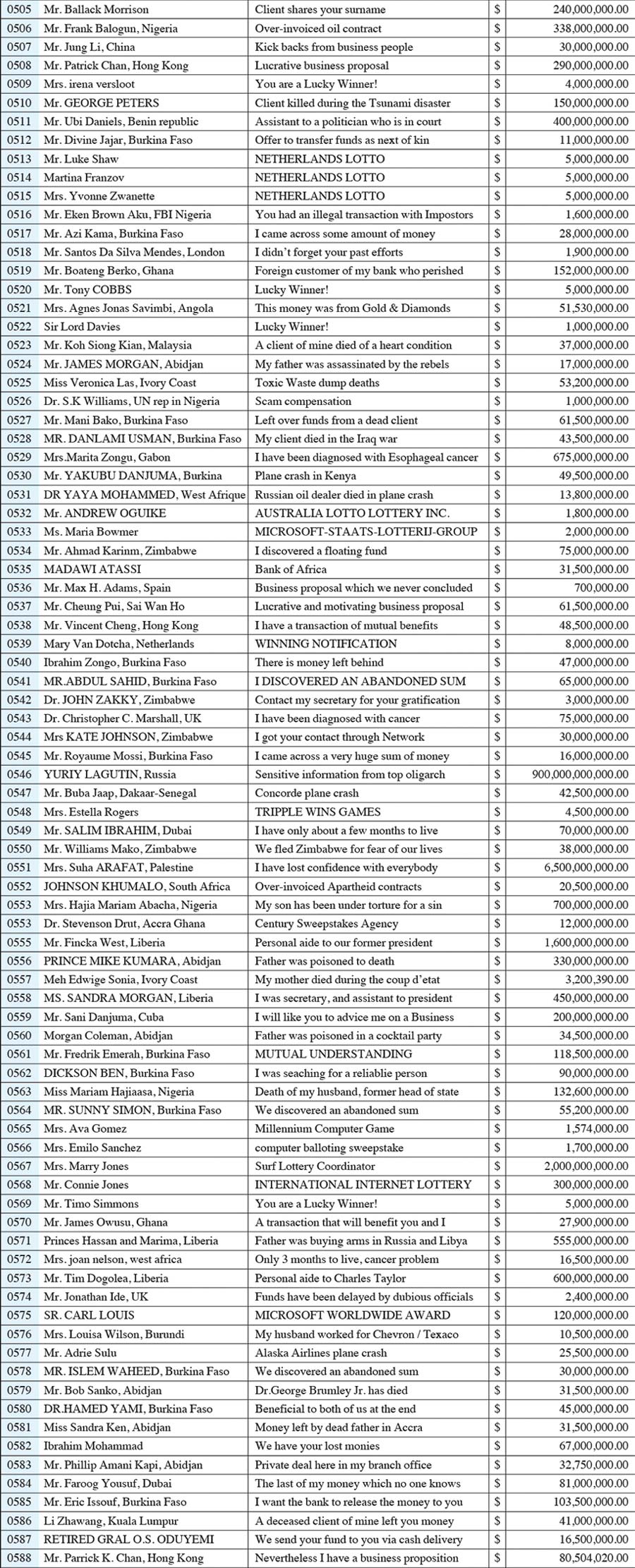

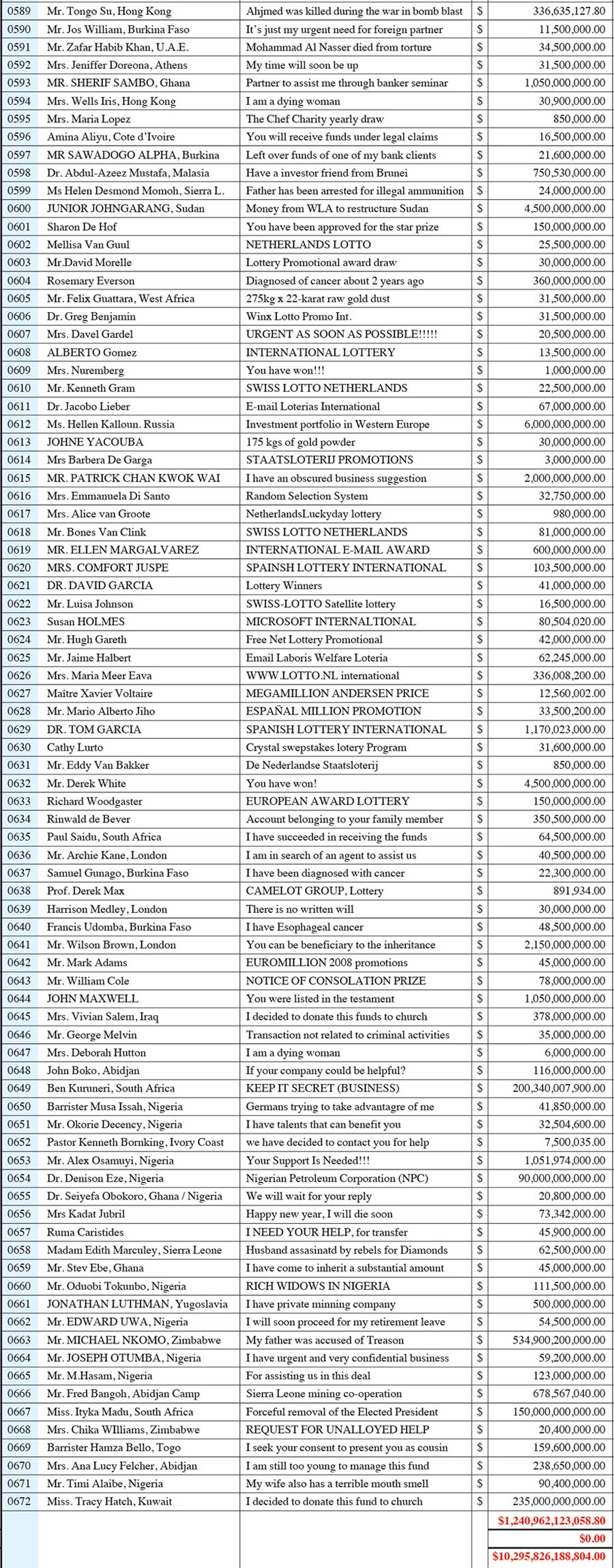

Rebels, dethroned kings, ousted heads of state, cancer-stricken widows—all are willing to hand over their riches. This source of wealth has been overlooked, but when added up, the amount of African money tied up as a result of these unfortunate circumstances is upwards of 10 trillion dollars, which, according to some estimates, is approximately the entire amount lost in the current financial crisis.

So, in the spirit of international cooperation, I offer here a guide to sources of money available to help resolve the current financial debacle. Feel free to contact prince.mustafa2@gmail.com for more details!

• • •

The best way to destroy the capitalist system is to debauch the currency.

—Vladimir Lenin

Julieta Aranda is a Mexican artist working in New York and Berlin. Her last solo exhibition in New York, “Tools for Infinite Monkeys,” was held at the Fruit and Flower Deli gallery in 2008, and in 2009 she will have solo presentations at the Guggenheim Museum, the Puerto Rico Triennial, and the Ljubljana Graphic Triennial, among others.

Spotted an error? Email us at corrections at cabinetmagazine dot org.

If you’ve enjoyed the free articles that we offer on our site, please consider subscribing to our nonprofit magazine. You get twelve online issues and unlimited access to all our archives.