The Crypto-Secessionists

Islands as fintech laboratories

Isabelle Simpson

Islands have played a key role in the development of the modern global economy as trading and military outposts, tax havens, and nuclear test sites serving colonial powers. In addition to their status as strategic economic and geopolitical satellites, islands are also special places that “have long been regarded as ideal sites for experimentation, in fiction and in reality, with their straightforward boundedness presumed to provide unambiguous limits to scope, ambition, and (if all goes wrong) contagion.”[1] Today, so-called Small Island Developing States are at the center of the development of central bank–issued digital currency. Their governments’ efforts to capitalize on digital currencies—as well as the accompanying discourse of fast-tracked economic development and democratization of the financial system promoted by the states and the technology and political entrepreneurs who court them—reaffirm the role of islands as sites of experimentation, this time as fintech laboratories.

Unlike cryptocurrencies such as Bitcoin and Ethereum, which are mined by individual nodes (computers) and were originally developed to provide an alternative to “fiat” money, central bank digital currencies (or CBDCs) are issued by central banks and are legal tender. Dozens of countries including India, Canada, Sweden, Laos, Bhutan, South Korea, and Haiti are exploring the possibility of developing their own digital currency. Meanwhile, the Bahamas and the Eastern Caribbean Union have already launched pilot projects, and the Marshall Islands, an impoverished island country located in the Pacific Ocean, passed a law to develop a cryptocurrency, the Sovereign, that would have legal tender and could, it is claimed, help the small island nation raise capital and emancipate itself from its dependence on US subsidies. A closer look at these three projects, all of which have been developed in partnership with foreign start-up companies, raises questions about the technology underpinning these new currencies, their sociopolitical and economic objectives, and about who is most likely to benefit from them.

As fintech laboratories, islands offer a space for projected fantasies of crypto-secession, “the phenomenon of individuals seceding from state-run institutions … by using cryptographic technologies such as Bitcoin and other blockchain applications to exit to virtual ‘states,’” and crypto-statecraft, “the practice of political entrepreneurs building new institutions using cryptographic technologies.”[2] In many respects, these projects echo the endeavors of libertarian entrepreneurs who in the 1960s and 1970s attempted to create micronations on islands. One such venture was Werner K. Stiefel’s Operation Atlantis, which was inspired by Ayn Rand’s Atlas Shrugged; its members minted their own currency, which they called the Deca because it contained a decagram of silver. The leaders of the Republic of Minerva, a project to establish a sovereign micronation on the Minerva Reefs in the South Pacific Ocean in the early 1970s, minted Minerva dollars made of gold and silver. The Principality of Sealand—a micronation established on a former World War II anti-aircraft platform seven miles off the British Coast in the North Sea, by a pirate radio operator and his family—has issued coins since 1972.[3] Island space is often imagined as an “experimental site where capitalism and civilisation might be reconstructed by the (usually) lone hero.”[4] Abandoned platforms and man-made and uninhabited islands all offer ideal playgrounds for libertarian and anarcho-capitalist entrepreneurs looking for a territory outside government control. Islands provided them with a political space of their own, an imagined blank slate over which they could reinvent society and challenge the discretionary monetary policies of their respective states.

Today’s CBDC experiments illustrate how islands are perceived as a “hosting paradise” for fintech entrepreneurs, as sites where new (de)regulations can be tried out and new sociocultural dynamics formed.[5] Islands are marketed as the ideal environment for fintech experiments, and digital currency and blockchain technology are promoted as innovative solutions that can propel these islands into the future and simultaneously celebrate their cultures and histories. Small island developing states’ banking infrastructure is often limited, fragile, and in need of modernization. Geographically, they are small enough that pilot projects can be rolled out quickly. Environmentally, they are at risk of being submerged and in dire need of financial and technological resources to address the issues caused by climate change. And, significantly, there is considerable profit to be made for those fintech entrepreneurs partnering with governments to develop and promote CBDCs. The services they offer include developing the digital architecture on which these currencies circulate and advising on the regulations that will shape the future of these island nations. Tropical beaches have become fintech sandboxes, but at what cost and with what potential consequences?

• • •

Cryptocurrencies are transacted using blockchain, a distributed ledger on which all transactions are recorded. Blockchain ledgers can be public or private, and the maintenance of ledger integrity within each option can be open to all (permissionless) or only to some subset of those on the network (permissioned). The Bitcoin and Ethereum blockchains are public: anyone can view pending and approved transactions and the digital wallets with which they are associated. Cryptocurrency transactions are made between pseudonymous wallets, and it can be near impossible to identify their owners. However, cryptocurrency exchanges’ Know-Your-Customer and anti-money laundering requirements, and the multiplication of blockchain forensic firms, mean that complete anonymity can be difficult to achieve. In theory, blockchain is a decentralized, and decentralizing, technology that purports to eliminate the need for third-party intermediaries and replace trust with mathematical computation. Authority is distributed among the nodes that verify and record transactions and that are rewarded with cryptocurrency for their work, a process known as proof-of-work. In practice, however, power is concentrated among the leading mining pools and exchanges, and “whales”—individuals or companies that own a significant amount of crypto. The price of cryptocurrency is subject to manipulation and fluctuates widely. Stablecoins, in contrast, are cryptocurrencies pegged to a currency or a commodity. Tether, for example, is a controversial and widely used stablecoin pegged to the US dollar. The controversy stems primarily from the fact that regulators have found that Tether lied about holding the reserves needed to back the tokens it continues to issue, and that its executives have troublesome professional histories. Ultimately, cryptocurrency (including stablecoins) and blockchain do not eliminate the issue of trust, but rather “shift” and “extend” trust in elite-led governance, and “reflect the wider pathologies that have long afflicted global financial integration.”[6]

A central bank digital currency is a digital version of part, or all, of a country’s existing money supply. While major economies have several projects under consideration or development, none has officially adopted a CBDC and research concerning which technical solutions would be best suited for such currencies is ongoing. If they opt to use blockchain, it would likely be a “private-permissioned” one.[7] Private-permissioned blockchains, such as those used in the cases discussed below, let several trusted participants access a ledger controlled by a centralized authority and allow for role-based oversight and visibility of transactions. A research note by staff analysts at the Bank of Canada published in February 2020 finds that the case for a blockchain approach to CBDCs “is not clear since its value is most evident in situations where there is no commonly trusted party, whereas in the case of a CBDC, the [central bank] would be the trusted party.”[8] According to the Atlantic Council’s Digital Currency Tracker, of seventy-one CBDCs projects at stages ranging from research to pilot projects, forty-nine are undecided on which digital infrastructure they will use, ten plan to use distributed ledger technology, and eleven plan to use a hybrid of blockchain and conventional centralized database.[9] Yet, the blockchain imaginary—the idea of a decentralized, transparent network that abolishes trust in third-party intermediaries and replaces it with trust in blockchain protocols, and in doing so restructures societies and their economies—plays a significant role in small island nations’ CBDC marketing. Due to its decentralized structure, blockchain, it is claimed, not only provides greater security and transparency, but is also a natural match for such states’ archipelagic geographies.

• • •

According to their proponents, CBDCs, which can be exchanged for goods via smartphones and cash cards, can facilitate economic activity, accelerate integration into the global economy, expand the range of financial services on offer, and boost economic growth and competitiveness. They can also be used for social engineering.

The Bahamas’ Sand Dollar was officially introduced in two pilot regions, first in the Abacos in December 2019 and then in Exuma in February 2020. Described as the “digital version,” or a “digital representation,” of the Bahamian dollar, the initiative was received with enthusiasm; 1,200 participants enrolled, more than double the initial projections of 500.[10] The currency is issued by the Central Bank of the Bahamas through authorized financial institutions (AFIs). There is an official Sand Dollar app, but AFIs may have their own applications as well. Currently, only Bahamian individuals and businesses can transact using the Sand Dollar. Funds are stored in a multi-tier digital wallet which users can access via a mobile phone application, either the Sand Dollar app or the AFI’s, or a physical card. To send money, a user scans a QR code or enters a unique custom name. In February 2021, Mastercard and Island Pay, a payment service provider licensed by the central bank, announced a new program that gives users of the Sand Dollar prepaid card the option to convert the digital currency to Bahamian dollars so that they can use the Mastercard at local businesses where Sand Dollars are not accepted, as well as elsewhere in the world. The strategic partnership with Mastercard gives credibility to the Sand Dollar Project, helps position Mastercard at the forefront of CBDC integration within global financial systems and, significantly, creates an incentive for Bahamians to become Mastercard clients.

The development of the Sand Dollar is part of the Bahamian Payments Systems Modernization Initiative, which began in the early 2000s. As part of this initiative, the Central Bank, the Ministry of Finance, and the clearing banks are collaborating to achieve a 50 percent reduction in the use of cash and an 80 percent reduction in the use of checks by 2025.[11] The primary stated objective of the Sand Dollar is to facilitate economic activity by reducing transaction costs and accelerating settlement speed, and increasing interoperability between banking service providers. As of 2019, the main retail payment system was the Bahamas Automated Clearing House Limited, jointly owned and operated by all commercial banks, which is responsible for clearing checks, direct debits, and credit transfers. Domestic debit and credit card are routed through the international card networks outside the country. Many remote communities have limited or no access to bank branches and ATMs: a survey conducted in 2018 by the central bank found that only 48 percent of individuals had access to credit card facilities.[12] The main benefit of the Sand Dollar digital currency services is convenience: they can be accessed from any island without the need for ATMs or bank branches, which are expensive to maintain, often scarce in remote locations, and likely to be damaged or destroyed in the event of natural disaster. The Sand Dollar, which has no transaction fees for individuals at this time and is designed to be used offline as well, promises to offer an instant payment system that can potentially drive down transactions costs for individual and merchants, a benefit particularly for small and medium businesses. The digital currency would also reduce the need to print cash and transport it to remote Bahamian islands.

It is unclear whether the Sand Dollar uses blockchain technology, although its developers claim it does. The central bank maintains a centralized ledger of all individual holdings of the digital currency.[13] It has selected NZIA Limited, a small company incorporated in the Bahamas in 2019, to develop the digital architecture of the Sand Dollar for an undisclosed fee. NZIA claims to have developed a “decentralized wireless payment system.” Its platform “integrates hybrid wireless communication networks, blockchain hardware nodes, edge processing capability and the NZIA Cortex DLT,” on which very little information is available.[14] The company claims to have offices in Canada, South Korea, Singapore, South Africa, and the Bahamas, and that it “brings together a world class team that also includes IBM and Zynesis” (a Singaporean “blockchain research and development lab and consultancy”), but its website lists only two individuals: chief operating officer Vinay Mohan, a management consultant specializing in blockchain technology, and chief executive officer Jay Joe, who, according to one online bio, holds a degree in chemical engineering from the University of British Columbia.[15] Joe has claimed NZIA has developed similar network infrastructure in Africa and Asia, but like additional detail on its principals’ backgrounds, information on these projects is not readily available online.[16]

The obscure nature of the technology underpinning the Sand Dollar, the lack of transparency about the partnership with NZIA, and the absence of details about how the digital currency functions raise questions about what exactly the Sand Dollar is. Yet it is meant to achieve ambitious societal goals, such as greater financial inclusion and eventually providing “non-discriminatory access to payment systems without regard for age, immigration or residency status.”[17] A stated goal of the Sand Dollar is to increase the population’s financial and digital literacy, and its adoption strategy relies on “sustained financial literacy campaigns to boost product awareness and encourage more positive behaviour around personal finances,” as well as in cybersecurity.[18] This includes a social media campaign on Instagram, and webinars for small business owners. The digital currency is also promoted as facilitating the inclusion of remote communities, the unbanked and the underbanked who are “outside of the cost-effective reach of physical banking services.”[19] It could, it is argued, facilitate registration for customers who may self-exclude from banking services because of the due diligence documentary requirements.[20] For instance, the Sand Dollar could facilitate the financial inclusion of migrant workers, many of whom are undocumented. (As of 2015, immigrants represented 15.3 percent of the Bahamas’ population.)[21] The government would benefit from improved expenditure and tax administration systems.[22] By creating a common, accessible digital economic network, the digital currency, it is claimed, can facilitate not only commerce, but the delivery of social services as well.

The Bahamian central bank does not plan on eliminating cash yet. In fact, the Sand Dollar is designed to create a user experience that “resembles cash.”[23] However, with CBDCs, consumers lose the “anonymity feature of cash” and we may find that our experience of money is less spontaneous, less personal, and more surveilled.[24] While users’ data can be anonymized, all transactions are recorded in a ledger maintained by the central bank. This suggests that one objective of the Sand Dollar is the formalization of all exchanges and the increased monitoring by the state both of informal and formal commercial transactions, as well as of individual behavior. The official Sand Dollar website claims that a user’s record of income and spending “can be used as supporting data for micro-loan applications.”[25] This might encourage individuals to modify their behavior in such a way that the ledger tells a particular story, paints a particular portrait that matches a specific set of requirements. Digital currency also imbues money with new value, making it possible to collect detailed data in real time on consumer spending and develop a better understanding of local dynamics. The Sand Dollar may help regularize informal businesses and economic transactions, and counter money laundering, but the strengthening of government oversight may also lead to new subtle forms of surveillance and control. Couched in the language of efficiency, resilience, and inclusivity, CBDCs may be at the service of the broader objectives of “financializing” populations and creating new “entrepreneurial subjectivities.” [26]

• • •

Digital currencies also open new businesses opportunities in the digital identity industry. In March 2021, the Eastern Caribbean Central Bank (ECCB) launched a digital currency, DCash, on the islands of Antigua and Barbuda, Grenada, Saint Christopher (St. Kitts) and Nevis, and Saint Lucia. Two years earlier, when the bank announced its decision to develop a digital currency, its governor Timothy N. J. Antoine said that they would “not outsource [their] development.”[27] DCash uses the IBM Hyperledger Fabric, a permissioned “distributed ledger platform.”[28] But it is unclear who owns and controls the digital architecture that supports the currency—which was designed and developed by Bitt, a Caribbean fintech company established in 2013, in partnership with the ECCB—and who will have the power to validate and view the data stored on the blockchain.

Bitt was originally a “Caribbean digital asset exchange” founded by Bitcoin enthusiasts and its core focus was to provide “access to cryptocurrencies in emerging markets.”[29] In 2016, it launched a blockchain-based version of the Barbadian dollar. This stablecoin functioned as a kind of digital IOU that could be sent and received.[30] Gabriel Abed, one of Bitt’s co-founders, stepped down as vice chairman of the company in 2020 and is now Barbados’s ambassador to the United Arab Emirates. In a direct message on Twitter, he wrote me: “My views on the future of CBDC is that Bitcoin is a superior form of money and financial solution for empowerment. 😊” In 2020, Bitt was acquired by Medici Ventures, which was launched in 2014 as a blockchain-focused subsidiary of Overstock.com, Inc., and is now a limited partnership managed by Pelion Venture Partners LLC, a venture capital firm headquartered in Salt Lake City. Medici Ventures invests in blockchain start-ups such as Medici Land Governance, a company that “uses blockchain and other technologies (such as cryptography, Artificial Intelligence and others) to support land governance, titling, and administration with a secure public record of land ownership,” and GrainChain, a company that uses blockchain to increase supply chain efficiency in the agricultural industry.[31] It also invests in digital voting and in several biometric and digital identity validation start-ups, such as Netki, an affiliate of Bitt.

Bitt currently describes itself as an organization dedicated to helping their “clients catalyze the imperative transformation from traditional currencies and legacy systems to fully operationalized CBDC and stablecoin platforms.”[32] It has been contracted by the National Bank of Belize, a government-owned commercial bank, to develop an eWallet, and by the government of Nigeria to develop the eNaira. Jonathan Johnson, Medici Ventures’ president from August 2016 to April 2021 and Overstock.com’s chief executive officer, described the partnership with ECCB as a “historic collaboration to eliminate middlemen, democratize capital, and rehumanize commerce.”[33] That governments enter into partnerships with private corporations to develop new services is not surprising, but whether the collaboration eliminates middlemen is debatable. In fact, CBDCs may accelerate the rise of what McKenzie Wark calls the “vectoralist class,” the ascending ruling class that owns and controls the vectors through which we transmit, store, and process information and “the legal and technical protocols for making otherwise abundant information scarce,” and is also able to “accumulat[e] asymmetric relations of information.”[34] For Medici Ventures and Bitt, the development of digital currencies offers a lucrative opportunity to strategically position themselves as information and technology brokers.[35] CBDCs may help countries accelerate financial inclusion and service delivery, but they also create new dependencies.

• • •

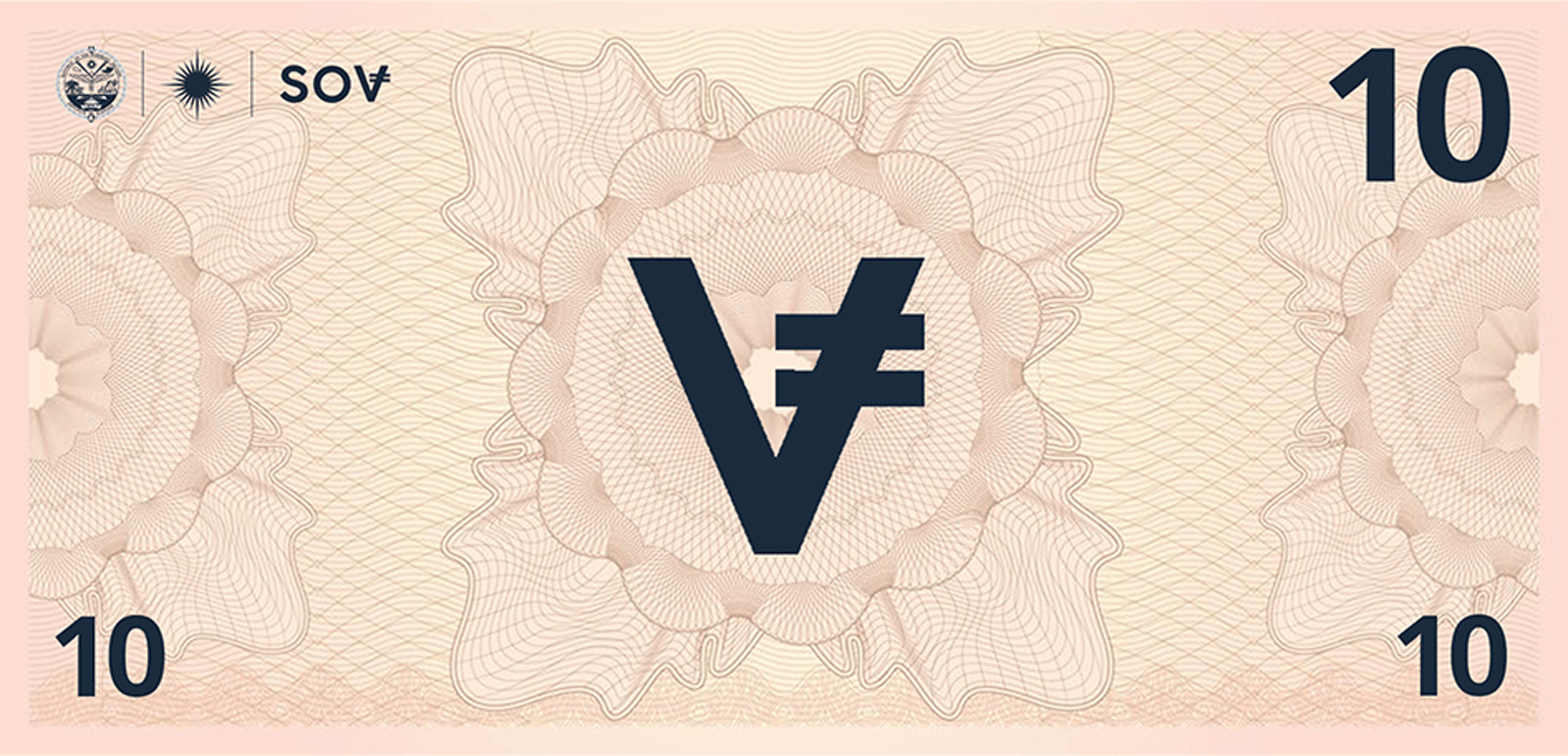

Despite these risks, countries may see in national digital currencies a means to assert or strengthen their claims to sovereignty. With a population of just under sixty thousand spread out over five islands and twenty-nine atolls, and a GDP of 239 million USD, the Republic of the Marshall Islands does not have a central bank. It uses the US dollar as its official currency. In 2018, the government passed the Sovereign Currency Act, launching a blockchain-based cryptocurrency called the sovereign (SOV) that cannot be redeemed for dollars and would circulate as a second legal tender. (The act later triggered a vote of no confidence against the country’s president, Hilda Heine.[36]) The Marshall Islands have been occupied, successively, by Spain, Germany, Japan, and the United States, the latter of which formally recognized its independence in 1979, and the name of the new currency is clearly meant to underline the country’s political and economic sovereignty. It is also presented as an innovative, albeit highly controversial, strategy to attract foreign capital to finance the fight against climate change in the country, and even to offer a universal basic income (UBI) to Marshallese and foreign investors.

Three percent of the newly minted SOVs would be distributed equally each year among all users who have been holding a minimal amount of the currency at a certain date or for a minimum period of time.[37] As more users subscribe to this UBI, the amount each receives will likely be reduced. The idea is that the UBI scheme will attract users and create a network effect that will help the currency gain value. The sovereign UBI would replace welfare and, it is argued, limit state intervention in the private life of citizens, who would no longer be subject to means tests. Nir Yaacobi, a self-employed Israeli consultant who, according to a Medium blog post he shared in June 2020, sits on the SOV Development Foundation board of advisors claimed that “based on Metcalfe’s law”—a controversial idea from the Internet boom that quantifies the value of a telecommunications network proportionally to number of users—“the value of SOV can be expected to grow quadratically with the numbers of users.” Foreign investors, presumably, would be attracted by the prospect of receiving free sovereigns that would gain in value. The RMI’s share of the profit from the initial issuance of the cryptocurrency can be invested in mitigation initiatives such as sustainable electricity generation and improved waste management, and in adaptation and resilience projects such as coastal protection, the climate-proofing of critical infrastructure, and securing food and water. No information on the projected carbon footprint of the sovereign is available, although the SOV will be minted and traded on the Algorand protocol, a proof-of-stake blockchain that, it is claimed, produces less carbon. With proof-of-stake, however, “each user’s influence on the choice of a new block is proportional to its stake (number of tokens) in the system.” This means that “the likelihood that a user will be chosen, and the weight of its proposals and votes, are directly proportional to its stake.”[38] Put simply: whoever holds the most sovereign units holds the most decisional power.

Another feature of the SOV that could attract investors is that, according to Yaacobi, its “monetary policy is governed by an algorithm rather than by a central bank.”[39] This is not entirely accurate. The Marshall Islands, as mentioned earlier, does not have a central bank, but the development and distribution of the sovereign will be controlled by a small group of individuals effectively acting as a centralized organization in charge of determining the monetary policy governing the issuance of sovereigns. The SOV’s development is spearheaded by the SOV Development Foundation, an independent non-profit corporation incorporated in the Marshall Islands. A press release lists an impressive advisory board, that includes Peter Dittus, the former secretary general of the Bank for International Settlements (BIS). Dittus joined the BIS in 1992, after working for the OECD and the World Bank, and left in 2016. He founded his own consultancy, arCandide Consulting, in 2017. The following year, he and a group of Israeli serial tech entrepreneurs co-founded SFB Technologies, a start-up that “is developing the technology platform to enable countries to issue digital currencies on the blockchain.”[40] SFB Technologies, which according to its LinkedIn page is headquartered in New York City, is tasked with developing the SOVchain, the blockchain on which the new cryptocurrency will be mined and transacted.[41] The other members are Silvio Micali, a Turing Award winner and the founder of Algorand; Luis Ubiñas, the former president of the Ford Foundation, which he left in 2013, and a member of the Advisory Committee for Trade Policy and Negotiations for the Obama administration; Mihaela Ulieru, a consultant in the field of technology and policy reform who, in 2020, joined Input Output, a company founded in 2015 by Charles Hoskinson, a co-founder of Ethereum, as a “strategic impact officer”; Steve Tendon, the architect of the blockchain strategy of the Republic of Malta; and Patri Friedman, the grandson of the neoliberal economist Milton Friedman who is best known for having co-founded the Seasteading Institute, a non-profit organization that advocates colonizing the oceans to “lower barriers to entry in the governance market” and experimenting with “competitive governance.”[42] What these technology and political entrepreneurs have in common in a shared belief that, as Dittus puts it, “true decentralized global finance” can “finally relieve the broken fiat banking system of its problems.”[43] Confusingly, the press release also mentions a Marshallese board of directors, but no information on this board is available online.

It is unclear what precisely the role of this inaugural advisory board is, and whether these six individuals are part of a seven-person governing board established in the SOV Development Foundation by-laws, two of whom are to be appointed by the cabinet of the Marshallese government and two by the “Appointed Organizer,” who is an agent designated by the minister of finance with the approval of the cabinet and tasked “with developing and implementing the sovereign.”[44] (The Appointed Organizer appears to be Dittus’s SFB Technologies, Inc., and as such it will also bear the cost of issuing the SOV and performing the initial coin offering.[45]) These four board members are charged with electing three additional members, “internationally recognized experts in monetary policy, digital payments technologies and blockchain.”[46] An election process to choose new board members is to be determined by the foundation at a later time “with elections based on the SOVchain itself.”[47]

The SOV Foundation makes a direct connection between the Marshall Islands’ vulnerability to climate change, its promotion of the sustainable use of resources, and the development of the SOV. A white paper authored by the foundation describes the SOV as “fair to users and sustainable in the long term as both a means of exchange and a store of value, similar to gold.”[48] The foundation asserts that it is “sustainable” not because of its digital characteristics, but because it “does not rely on a central bank but instead Milton Friedman’s k-percent rule,” which it misconstrues to mean that central banks should increase the money supply by a constant percentage rate every year, irrespective of economic conditions.[49] The supply of sovereigns would increase by 4 percent annually to match the estimated growth of world GDP. The argument is that by having the monetary policy rule embedded as law in the blockchain code, users will benefit from the “certainty that the government cannot issue additional currency to advance policy objectives.”[50] But this could also limit the ability of the government to intervene, and it may even find itself constrained by unelected foreign actors tasked with developing the SOV and overseeing its distribution. The arrangement hardcodes neoliberalism into the technology and sediments the belief that “code is law,” effectively transferring power to a small group of individuals and limiting the possibility of democratic oversight.

Twenty-four million sovereigns would be issued initially. Of these, 50 percent would be held in trust by the Marshallese government and would, following the initial coin offering, be divided between the country’s National Trust Fund; Green Climate Fund; Nuclear Legacy and Healthcare Fund; and the Resident-Citizens SOV Allocation Fund. The Sovereign Currency Act 2018 states that the “appointed Persons or Organizers” will receive the other 50 percent of the initial issuance.[51] The white paper states that 30 percent of the initial issuance would be held by the SOV Development Foundation, which would use the funds to “invest in the development of the digital economy of the Marshall Islands and beyond,” 10 percent would be held by the Appointed Organizer “to fund the development of the sovereign and the underlying verification protocol technology” by distributing sovereign units “to those who contribute to the project as an incentive to build and develop the sovereign and the ecosystem around it,” and the remaining 10 percent would be sold to early investors. [52] Contradicting the white paper it authored, the SOV Development Foundation states on its website that 10 percent of the initial supply will be allocated to Marshallese citizens and 40 percent will be available for sale to foreign investors.[53] The network will be accessible to approved users only, presumably to meet international anti-money-laundering requirements.

The white paper claims the cryptocurrency would offer more privacy than CBDCs because transactions would be pseudonymous and executed using digital IDs.[54] However, despite this promise, both are subject to financial institutions’ Know Your Customer rules and the sovereign offers no better privacy than a CBDC. The key difference is that, in this case, the power that would normally reside with the central bank is transferred to a group of foreign non-state actors, including a network of verifiers. In other words, while it would be possible to transact sovereigns using pseudonymous digital IDs, one would still have to verify the user’s true identity with an independent authority. The verification process for SOV users will be outsourced to third parties, who will be rewarded through a “seigniorage reward payment” and receive a certain amount of sovereigns for their work, which means that they have a financial incentive to assess as many users as possible.

The SOV Administrative Authority, an office to be created within the Ministry of Finance, would have the power to delegate the verification process to a “network of Verifiers, dubbed the SOV Trust Network” who, in turn, could also be given the authority to “approve secondary verifiers.”[55] All verifiers would have to be “in good international standing” and be “maintained in regulated jurisdictions, such as Exchanges licensed or chartered by the New York State Department of Financial Services.”[56] SOV users will be able to choose among a number of “accredited Verifiers” and select the one they most “trust to keep their identity information private and not to leverage information for profit beyond the incentive mechanism built into the chain.”[57] There is no information on what provisions will be in place to address the consequences of a verifier who turns out not to be trustworthy. Complicating things further, “users may choose to operate multiple verified accounts, which may be approved by different Verifiers.”[58] This, it is argued in the white paper, increases the privacy of users without compromising the security of the system.

The SOV Administrative Authority would also be responsible for providing “approval and licensing” for twenty-one block producers, who would be the “decentralized entities that propose and confirm the blocks of the SOV blockchain.”[59] Just as Bitcoin miners get rewarded in the currency for confirming transactions, SOV block producers (miners) would be “incentivized by block rewards” according to their participation. Miners, which include both the “block producers” and the “Verifiers,” would receive 1 percent of the annual 4 percent “Yearly Network Issuance,” with 0.75 percent going to the former and 0.25 percent to the latter.[60] Once twenty-one block producers have been selected, “anyone who has permission to use the network can choose to participate in selecting block producers in a continuous voting system.”[61] The white paper claims that this “would allow the community to share in the control of which entities are trusted to maintain the consensus and governance of the blockchain.”[62] But this structure raises questions about who will be entrusted with maintaining the integrity of the blockchain and who will be able to join the community and actively participate in decision making. Becoming a licensed “block producer” will require modern IT equipment and a reliable internet connection, both of which are not easily accessible in the Marshall Islands where, in 2017, less than 40 percent of the population used the internet.[63] Moreover, the twenty-one block producers selected by the SOV Administrative Authority will benefit from first mover advantage, meaning that they could potentially acquire a significant supply of the circulating SOV.

The SOV proposal is a speculative crypto experiment that transfers power to a group of foreign individuals wishing to test their economic hypothesis for how to, in the words of Peter Dittus, fix “the broken fiat banking system.” It is unclear how the Marshallese would directly benefit from it. Unlike the Sand Dollar and DCash, the SOV would be immediately available for international use and the success of the project largely depends on the profitable sale of “pre-sovereign units” via auctions to raise capital. These would then be exchanged for sovereigns once the currency is officially launched.[64] The white paper states that “half the sovereign issuance is projected to be to holders who are unlikely to want to spend their sovereigns on goods in the Marshall Islands.”[65] We can assume these holders would partake in the initial coin offering with the expectation that the value of the currency will rise. In fact, the white paper states that the only sovereigns that will circulate will be the ones issued to resident-citizens and that “the impact on the local economy should be limited.”[66] What then, is the real objective of this new cryptocurrency and how can it help the Marshallese?

What incentive early investors would have, especially non-Marshallese investors, beyond speculative interest (or perhaps unalloyed altruism), is unclear. But even if the pre-sale was widely successful, the fact that power over the creation, validation, and distribution of the SOV is concentrated in the hands of a tight group of foreign entrepreneurs means that that the experiment will jeopardize the country’s already fragile economic situation. No less a bastion of neoliberal economic policy than the IMF has expressed strong concerns about the macroeconomic and financial risks the SOV could create.[67] The sovereign scheme may, in fact, be nothing else than a scheme by a group of foreign entrepreneurs and local officials to leverage the weakness of the Marshallese economy and the critical ecological situation it faces in order not only to enrich themselves, but to use the small island nation as a political laboratory where neoliberal and gold-bug theories can be tested.

• • •

One of the ways in which the SOV Development Foundation and the Marshallese politicians who support the project have attempted to make the scheme palatable is by connecting the discourse of decentralization around cryptocurrency and blockchain technology to the historical identity of the Marshallese. Olivier Jutel has coined the term “Pacific Ideology,” a reference to the “California Ideology” famously described in the mid-1990s by media theorists Richard Barbrook and Andy Cameron, to describe “these fantasies [that] imagine blockchain as analogue to indigenous cultures and authentic mediation.”[68] Senator David Paul—who supports both the SOV and the development of a Digital Economic Zone on Rongelap, an uninhabited atoll and former nuclear testing site which would use the SOV as its official currency—argues that blockchain is the most appropriate technology for the Marshallese, who “have lived with decentralized systems for hundreds of years.”[69]The SOV white paper also suggests that “decentralization has … been part of the Marshallese way of life for centuries,” and presents the development of the cryptocurrency as a logical next step in the country’s history: “The Marshallese, heirs to a long tradition of exploration and expert navigation, are now charting a new course for themselves.”[70]

This discourse is highly similar to that used to promote the construction of a floating island in French Polynesia in 2017–2018, which would also have had its own cryptocurrency. France’s overseas collectivity made international headlines when it announced it had signed a memorandum of understanding with the Seasteading Institute, co-founded by Patri Friedman in 2008, to examine the feasibility of building an artificial island in the archipelago’s territorial waters. To develop the project, Seasteading Institute staff, investors, and interested parties founded Blue Frontiers (slogan: “We build sustainable floating islands with unique governing frameworks”), a for-profit private limited company that they incorporated in Singapore because of its friendly position regarding cryptocurrency trading.

To raise capital, Blue Frontiers launched an initial coin offering for the Varyon cryptocurrency (named to reference “increasing variation in governance”) at a time when there was significant momentum for alternative cryptocurrencies and the market for such offerings was reaching its highest point of growth. Varyon would have been the only currency used on the floating island.[71] Promotional documents and talks by the supporters of the project, both local and foreign, presented it as bolstering French Polynesian self-sufficiency by positioning the archipelago at the forefront of sustainable adaptation in the south Pacific. French Polynesians were repeatedly described as “the original seasteaders,” and seasteading as inherent to their culture and even essential to the survival and advancement of their traditional way of life. It was also implied that Polynesians were in dire need of help from American venture technologists to face the challenges of rising sea levels in their environment.

This is not the first time fintech entrepreneurs have attempted to build encrypted utopias on islands ravaged by natural disasters. In 2018, dozens of crypto-entrepreneurs, attracted by Puerto Rico’s absence of federal personal income tax or capital gains tax, relocated themselves and their businesses to the island, and proposed to develop a crypto-utopia using “blockchain infrastructure” to renew urban development in Puerto Rico after Hurricane Maria.[72] The initiative, initially named Puertopia but rebranded as Sol, was led by Brock Pierce—a former child actor and now Bitcoin personality who ran as an independent candidate for the US presidency in 2020—and a group of crypto-enthusiasts who had set up base in a four-star hotel. In March 2018, the group held a blockchain summit conference called Puerto Crypto. Indeed, post-disaster Puerto Rico offered potentially fruitful opportunities for fintech experimentation. In May of that year, the Startup Societies Foundation (recently rebranded as the Startup Societies Network), a non-profit that advocates the development of experimental, small-scale communities to explore alternatives to the nation-state model of governance,” also held its annual summit, that year at George Mason University in Virginia, under the theme “Rebuild Puerto Rico” and invited participants to “discuss how special jurisdictions, blockchain technology and green infrastructure will rebuild Puerto Rico.”[73] Puertopia/Sol has not achieved anything substantial for Puerto Ricans. It did, however, create an encrypted, insular geography whose physical center was the twenty-thousand-square-foot hotel occupied by the crypto-utopians. As Jillian Crandall argues: “Although there are no physical walls gating” such crypto-utopias in San Juan, “there are digital walls and gates that keep anyone out unless they are high net-worth ‘accredited investors’ …, and on the inside in the ‘blockchain space.’”[74]

What makes Puerto Rico and the Marshall Islands attractive to crypto-entrepreneurs is how islands offer spaces where “empathy and control are simultaneously possible. … All that exists, whether cultural, economic or physical, can be observed and regulated, qualities that have ensured that islands have been both seen and used as laboratories and which have implied that, in isolation, utopian communities might exist, be established and evolve there.”[75] Entrepreneurs and crypto-friendly politicians can present their fintech solutions as a form of benevolent capitalism, one that promises not only to fast-track the integration of Small Island Developing States in the global economy, but to create new wealth—magic internet money—that could be used to address complex socioeconomic issues and the existential threat of climate change. These ventures’ marketing typically implies that islanders’ way of life somehow prefigured the development of blockchain technology, which is then marketed as a logical next-step in the fight against climate change and cultural survival for these island nations.

In the case of the Marshall Islands, there is a risk that by outsourcing so much of the digital infrastructure underpinning the production and the governance of the new cryptocurrency, the small nation loses, rather than gains, control over its economic sovereignty. The Marshallese sovereign and the CBDC experiments of the Bahamas and of the Eastern Caribbean all carry risk, which is disproportionately borne by the citizens of the participating countries. Ultimately, these early national cryptocurrency and CBCD experiments are closer to extractive schemes that will enrich one set of people at the risk of destabilizing these countries’ economies. Small island nations are once again laboratories for the financial centers of the world.

Aside from currency projects, Small Island Developing States have been experimenting with blockchain for some time now, using it, among other things, to boost tourism by facilitating reservations, ticketing, and payment, and to capitalize on the marketing opportunities offered by identity management.[76] In Vanuatu, a program in partnership with Oxfam called UnBlocked Cash is using the technology to deliver humanitarian assistance using e-voucher tap-and-pay cards, smartphones with a pre-installed app, and a single-payment online platform that allows NGOs to disburse funds and monitor transactions remotely and in real time.[77] Tuvalu, a small nation of nine islands with a population of eleven thousand that does not have an electronic banking system, is developing a National Digital Ledger with the goal of becoming a paperless society. Should Tuvaluans be forced to relocate due to rising sea levels, the ledger could move with them and help preserve social and institutional structures. Jutel argues that such projects reveal “the Pacific’s role as a blockchain frontier,” itself a “product of regulatory weakness and a desire for tech-development that allows NGOs and developers to innovate and experiment for their own ends.”[78] The Pacific blockchain frontier, he argues, is the product of the convergence of “the desire for a new world built upon blockchain technology, the fetishization of indigenous people and cyber-libertarian island fantasies.”[79]

The CBDC experiments and national cryptocurrency ventures discussed in this essay all present small islands as a fintech frontier, one that is open to colonization and where data, wealth, and sovereignty can be extracted by technology and political entrepreneurs. To the libertarians and crypto-secessionist entrepreneurs looking for a place that offers an exit from the state and its monetary policies, those islands are sites of “wishful sinking” that serve to confirm the urgency of climate change and where climate catastrophe can turned into a profitable business opportunity.[80] Yet, crypto-utopians readily ignore or dismiss the fact that these islands are not blank slates with Wi-Fi connections; they are a people’s home, and whereas the experimenters can always evacuate the laboratory if something goes wrong, it is not the case for their test subjects, who will be the ones dealing with the long-term consequences.

- Adam Grydehøj and Ilan Kelman, “Island Smart Eco-Cities: Innovation, Secessionary Enclaves, and the Selling of Sustainability,” Urban Island Studies, vol. 2 (2016), p. 6. Available at researchgate.net/publication/307992841_Island_Smart_Eco-Cities_Innovation_Secessionary_Enclaves_and_the_Selling_of_Sustainability.

- Trent J. MacDonald, The Political Economy of Non-Territorial Exit: Cryptosecession (Cheltenham, UK: Edward Elgar, 2019), pp. 63–64.

- James Grimmelmann, “Sealand, HavenCo, and the Rule of Law,” University of Illinois Law Review, vol. 2012, no. 2 (2012), p. 424. Available at scholarship.law.cornell.edu/cgi/viewcontent.cgi?article=2628&context=facpub.

- John Connell, “Island Dreaming: The Contemplation of Polynesian Paradise,” Journal of Historical Geography, vol. 29, no. 4 (October 2003), p. 563.

- Mascha Gugganig, “Hawai‘i as a Laboratory Paradise: Divergent Sociotechnical Island Imaginaries,” Science as Culture, vol. 30, no. 3 (10 February 2021). Available at academia.edu/45102923/Hawai%CA%BBi_as_a_Laboratory_Paradise_Divergent_Sociotechnical_Island_Imaginaries.

- Malcolm Campbell-Verduyn and Marcel Goguen, “Blockchains, Trust and Action Nets: Extending the Pathologies of Financial Globalization,” Global Networks, vol. 19, no. 3 (July 2019), pp. 319, 316.

- Yuan Yang and Hudson Lockett, “What Is China’s Digital Currency Plan?,” Financial Times, 25 November 2019.

- Dinesh Shah et al., “Technology Approach for a CBDC,” Bank of Canada staff analytical note, February 2020. Available at bankofcanada.ca/2020/02/staff-analytical-note-2020-6.

- Atlantic Council, “Central Bank Digital Currency Tracker.” Available at www.atlanticcouncil.org/cbdctracker.

- As of November 2021, there were just over $300,000 worth of Sand Dollars in circulation, and “most exchanges were between wallet platforms and not real spending at merchants.” See Chester Robards, “Sand Dollar Circulation Grows but Spend Still Low,” The Nassau Guardian, 2 November 2021. Available at thenassauguardian.com/sand-dollar-circulation-grows-but-spend-still-low. The Central Bank of the Bahamas expects that as infrastructure interoperability improves, adoption and spending will increase. This slow uptake suggests a possible lack of trust in the Sand Dollar after a wave of initial enthusiasm, and that the project is likely not as advanced or as disruptive as the media hype around it has tended to imply.

- The Central Bank of the Bahamas, “The Bahamas Business Digital Payments Survey (2020),” June 2021, p. 2. Available at cdn.centralbankbahamas.com/documents/2021-06-14-16-02-44-Results-of-the-Business-Digital-Payments-Survey-2020-14Jun2021.pdf.

- The Central Bank of the Bahamas, “An Analysis of the Bahamas Financial Literacy Survey 2018,” p. 6. Available at centralbankbahamas.com/viewPDF/documents/2019-06-19-07-42-48-Analysis-of-the-Bahamas-Financial-Literacy-Survey-2018.pdf.

- See Sand Dollar, “Key Players.” Available at sanddollar.bs/keyplayers#inner-banner.

- See NZIA, homepage. Available at nzia.io.

- Ibid. For a short biography of Joe, see his guest speaker listing for a 2019 client seminar hosted by the Bahamian law firm of Higgs & Johnson. Available at higgsjohnson.com/fast-forward-regulation-legislation-application.

- Neil Hartnell, “Provider for Digital B$ ‘Will Not Be Greedy,’” The Tribune, 31 May 2019. Available at tribune242.com/news/2019/may/31/provider-digital-b-will-not-be-greedy.

- Sand Dollar, homepage. Available at sanddollar.bs.

- Sand Dollar, “Public Update — Gradual National Release to the Bahamas in October 2020,” 25 September 2020. Available at sanddollar.bs/publicupdates/public-update-gradual-national-release-to-the-bahamas-in-october-2020.

- See Sand Dollar, “About Us.” Available at sanddollar.bs/about.

- Central Bank of the Bahamas, “Project Sand Dollar: A Bahamas Payments System Modernisation Initiative,” 24 December 2019, p. 6. Available at centralbankbahamas.com/viewPDF/documents/2019-12-25-02-18-11-Project-Sanddollar.pdf.

- International Organization for Migration, “Facts and Figures.” Available at iom.int/node/106764/facts-and-figures.

- Central Bank of the Bahamas, “Project Sand Dollar: A Bahamas Payments System Modernisation Initiative,” p. 6.

- Sand Dollar, “Public Update — Gradual National Release to The Bahamas in October 2020.”

- Ibid.

- Sand Dollar, homepage.

- See Imre Szeman, “Entrepreneurship as the New Common Sense,” The South Atlantic Quarterly, vol. 114, no. 3 (July 2015).

- Eastern Caribbean Central Bank, “Bitt Partners with ECCB to Develop World’s First Central Bank Digital Currency in a Currency Union,” 31 March 2021. Available at eccb-centralbank.org/news/view/bitt-partners-with-eccb-to-develop-worldas-first-central-bank-digital-currency-in-a-currency-union.

- IBM, “What is Hyperledger Fabric?” Available at ibm.com/ae-en/topics/hyperledger.

- See the company’s archived Crunchbase page at web.archive.org/web/20181210092731/https://www.crunchbase.com/organization/bitt.

- Pete Rizzo, “Bitt Launches Barbados Dollar on Blockchain, Calls for Bitcoin Unity,” Coindesk, 24 February 2016. Available at coindesk.com/bitt-launches-barbados-dollar-on-the-blockchain-calls-for-bitcoin-unity.

- See Medici Land Governance at mediciland.com and GrainChain at grainchain.io.

- Bitt, “About Us.” Available at bitt.com/about/overview.

- Eastern Caribbean Central Bank, “Bitt Partners with ECCB to Develop World’s First Central Bank Digital Currency in a Currency Union.”

- McKenzie Wark, Capital Is Dead: Is This Something Worse? (London: Verso, 2019), pp. 13, 45, 98.

- Such positioning is not without its difficulties: in January 2022, the DCash platform experienced a service interruption for several weeks due to what was described as a “technical issue.” See Eastern Caribbean Central Bank, “Region-Wide Service Interruption of DCash Platform,” 14 January 2022. Available at eccb-centralbank.org/news/view/region-wide-service-interruption-of-dcash-platform. See also Jim Wyss, “Caribbean Digital Currency, DCash, Remain Offline for Second Week,” Bloomberg, 28 January 2022. Available at bloomberg.com/news/articles/2022-01-28/caribbean-digital-currency-dcash-remains-offline-for-2nd-week.

- Eleanor Ainge Roy, “Plans for Digital Currency Spark Political Crisis in Marshall Islands,” The Guardian, 5 November 2018. Available at theguardian.com/world/2018/nov/06/plans-for-digital-currency-spark-political-crisis-in-marshall-islands.

- Nir Yaacobi, “SOV Is Announcing a New Feature: Built-in UBI to Its Holders,” Medium, 30 June 2020. Available at medium.com/@sovfoundation/sov-is-announcing-a-new-feature-build-in-ubi-to-its-holders-c201f82aec48.

- See algorand.com/technology/pure-proof-of-stake.

- Ibid.

- “SFB Technologies, Inc,” LinkedIn. Available at linkedin.com/company/the-sovereign-sov-global/about.

- In March 2020, a partnership with Algorand Inc., a private corporation based in Boston and founded by MIT professor Silvio Micalo, was announced. See SFB Technologies, “Marshall Islands to Power World’s First National Digital Currency with Algorand and SFB Technologies,” 2 March 2020. Available at algorand.com/resources/news/marshall-islands-to-power-worlds-first-national-digital.

- Ulieru’s job history can be found at linkedin.com/in/mihaelaulieru. The members of the advisory board can be found in a 9 September 2020 SOV Foundation press release titled “Council of Economic Advisors to Ring in Marshall Islands’ Final Phase to Launch First Auction of Sovereign Subscription Rights (SSRs) to Its National Digital Currency.” Available at globenewswire.com/news-release/2020/09/09/2090848/0/en/Council-of-Economic-Advisors-to-Ring-in-Marshall-Islands-Final-Phase-to-Launch-First-Auction-of-Sovereign-Subscription-Rights-SSRs-to-its-National-Digital-Currency.html. The two phrases about the Seasteading Institute’s goals can be found in Patri Friedman and Brad Taylor, “Seasteading: Competitive Governments on the Oceans,” Kyklos, vol. 65, no. 2 (May 2012), pp. 224, and Friedman and Taylor, “Seasteading and Institutional Evolution” (paper presented at the Association of Private Enterprise Education Conference, Nassau, The Bahamas, 10–12 April 2011), p. 14, respectively. The latter is available at academia.edu/27111624/Seasteading_and_Institutional_Evolution.

- SOV Foundation, “Council of Economic Advisors to Ring in Marshall Islands’ Final Phase.”

- SOV Development Foundation, “The Marshallese Sovereign (SOV): Fair, Sustainable Money, Version 1.3,” 10 September 2019, p. 18. Available at docsend.com/view/nvi59vw.

- Republic of the Marshall Islands, “Declaration and Issuance of the Sovereign Currency Act 2018,” p. 4. Available at sov.foundation/law.pdf.

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” p. 17.

- See sov.foundation/sov-foundation.

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” p. 1.

- See SOV Foundation, “Council of Economic Advisors to Ring in Marshall Islands’ Final Phase.”

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” p. 16.

- Republic of the Marshall Islands, “Declaration and Issuance of the Sovereign Currency Act 2018,” p. 7.

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” pp. 13–15.

- The Sovereign Currency Act states that of the 12 million sovereigns initially allocated to it, the Republic of the Marshall Islands will sell 6 million at the initial currency offering and distribute the proceeds among the four different funds. Adding this allotment to the 10 percent that the white paper states will be sold to investors from the SOV Foundation’s 12 million sovereigns, the total available for early sale would be 8.4 million sovereigns, which is equivalent to 35, rather than 40, percent of the total.

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” p. 4.

- Ibid, p. 10.

- Ibid, p. 18.

- Ibid, p. 10.

- Ibid, p. 11.

- Ibid.

- Ibid, pp. 11–13.

- Ibid, p. 11.

- Ibid.

- The World Bank, “Individuals Using the Internet (% of Population) — Marshall Islands.” Available at data.worldbank.org/indicator/IT.NET.USER.ZS?locations=MH.

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” pp. 15–18.

- Ibid, p. 19.

- Ibid.

- International Monetary Fund, “Press Release No. 21/142: IMF Executive Board Concludes 2021 Article IV Consultation with the Republic of the Marshall Islands,” 27 May 2021. Available at imf.org/en/News/Articles/2021/05/27/pr21142-marshall-islands-imf-executive-board-concludes-2021-article-iv-consultation.

- Olivier Jutel, “Blockchain Imperialism in the Pacific,” Big Data & Society, vol. 8, no. 1 (January 2021), p. 2.

- David Paul, “Why the Marshall Islands Is Issuing Its Own Cryptocurrency,” Coindesk, 4 September 2019. Available at coindesk.com/why-the-marshall-islands-is-issuing-its-own-cryptocurrency.

- SOV Development Foundation, “The Marshallese Sovereign (SOV),” p. 8.

- Blue Frontiers, “Varyon — Increasing Variation in Governance” (promotional video), 2 May 2018. Available at youtube.com/watch?v=LwCu4IuSmvc.

- Nellie Bowles, “Making a Crypto Utopia in Puerto Rico,” The New York Times, 2 February 2018. Available at nytimes.com/2018/02/02/technology/cryptocurrency-puerto-rico.html.

- For the language describing the summit, see web.archive.org/web/20201024143606/https://btcmanager.com/events-list/startup-societies-summit.

- Jillian Crandall, “Blockchains and the ‘Chains of Empire’: Contextualizing Blockchain, Cryptocurrency, and Neoliberalism in Puerto Rico,” Design and Culture, vol. 11, no. 3 (September 2019), p. 288.

- John Connell, “Island Dreaming: The Contemplation of Polynesian Paradise,” Journal of Historical Geography, vol. 29, no. 4 (October 2003), p. 555.

- See Andrei O. J. Kwok and Sharon G. M. Koh, “Is Blockchain Technology a Watershed for Tourism Development?,” Current Issues in Tourism, vol. 22, no. 20 (2019).

- Oxfam, “UnBlocked Cash Project: Using Blockchain Technology to Revolutionize Humanitarian Aid.” Available at oxfam.org/en/unblocked-cash-project-using-blockchain-technology-revolutionize-humanitarian-aid.

- Olivier Jutel, “Blockchain Imperialism in the Pacific,” p. 2.

- Ibid., p. 11.

- See Carol Farbotko, “Wishful Sinking: Disappearing Islands, Climate Refugees and Cosmopolitan Experimentation,” Asia Pacific Viewpoint, vol. 51, no. 1 (April 2010).

Isabelle Simpson works at a private investment firm in Montreal. She holds a PhD in geography from McGill University. Her research examines projects that aim to develop private cities by leveraging blockchain technologies and special economic zones.

Spotted an error? Email us at corrections at cabinetmagazine dot org.

If you’ve enjoyed the free articles that we offer on our site, please consider subscribing to our nonprofit magazine. You get twelve online issues and unlimited access to all our archives.